We recently launched our new website

We recently launched our new website and will be adding blog content and important forms to it on a regular basis.

Check it out and let us know what you think and what you'd like to see included in the future.

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help. Contact us today at 281-789-7229 and let our skilled professional assist you with your letter from the IRS (and more).

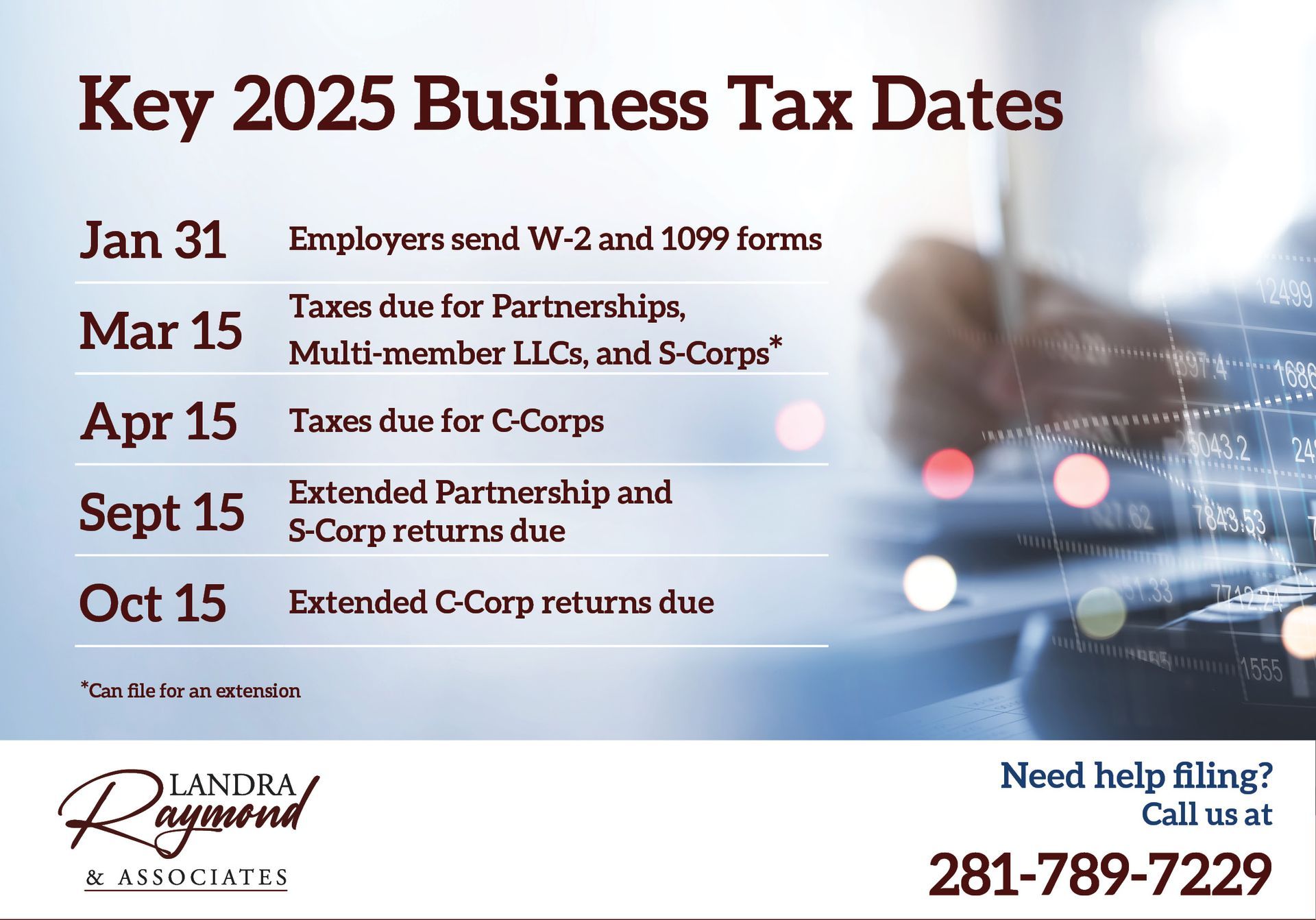

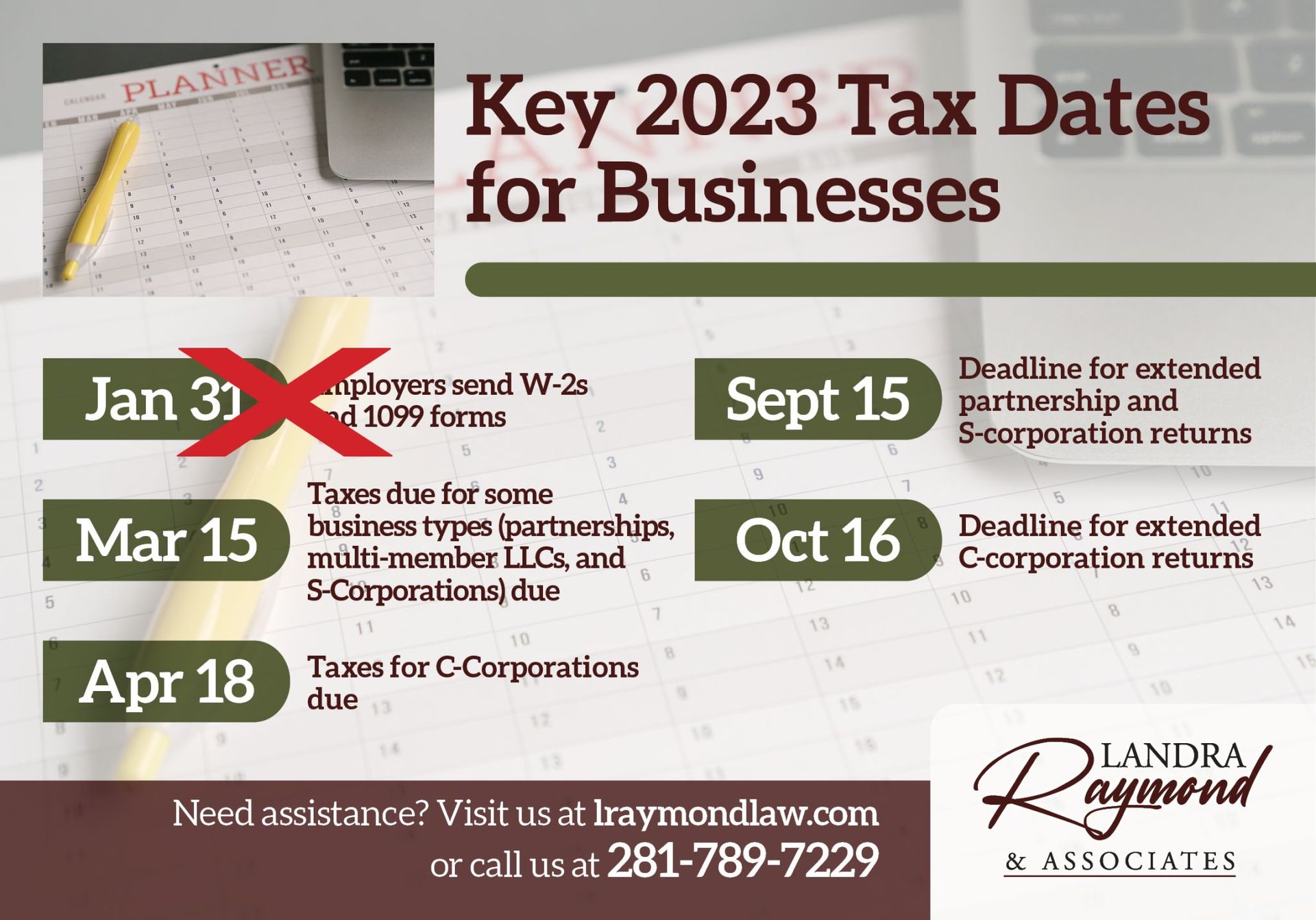

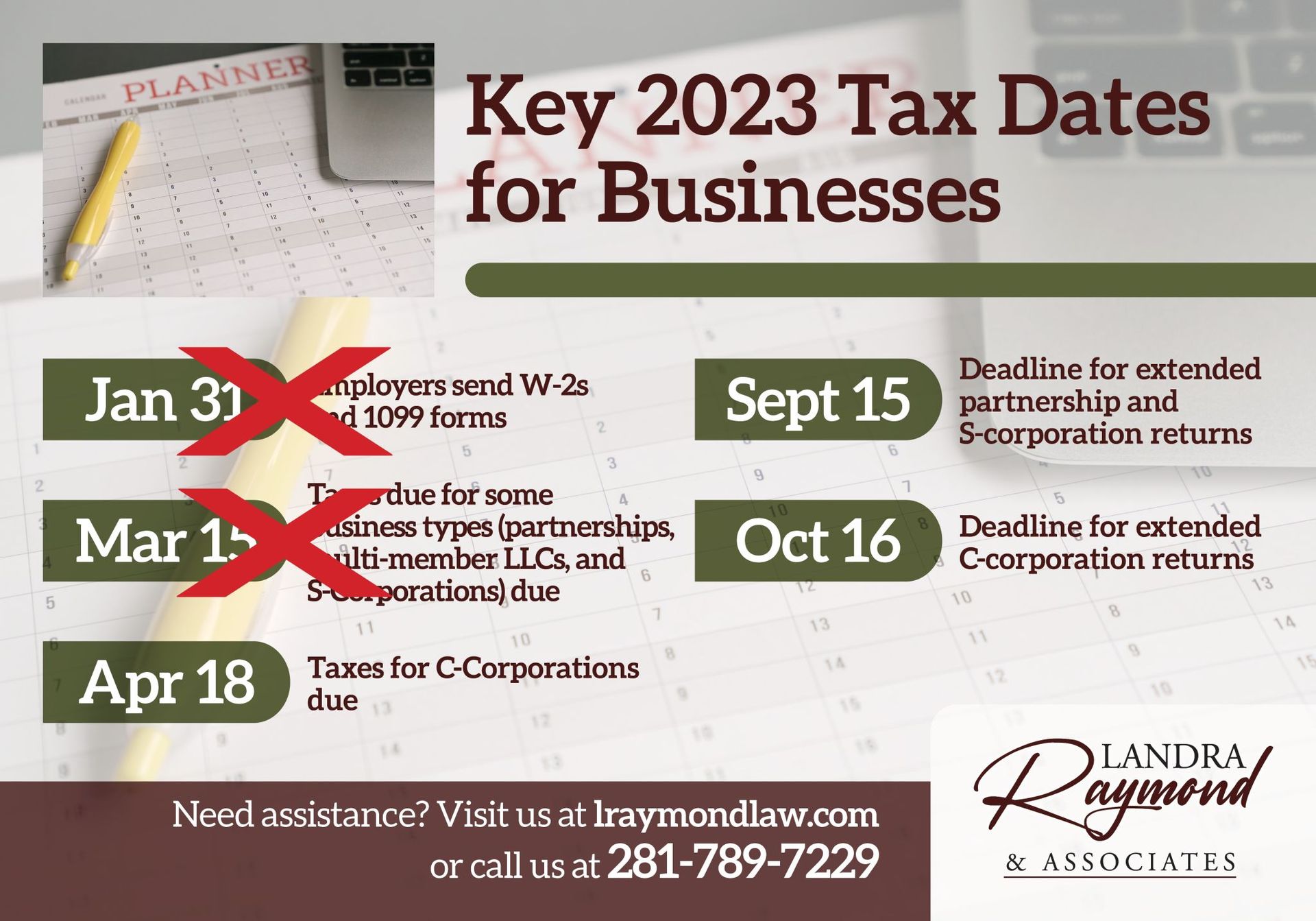

The last major business tax deadline is October 16, when your extended C-corporation returns are due. Are you ready to submit everything to the IRS? With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready to submit your extended partnership and S-corporation returns? The deadline is September 15, and will be here shortly. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines. The next deadline is Oct 16: extended C-corporation returns due.

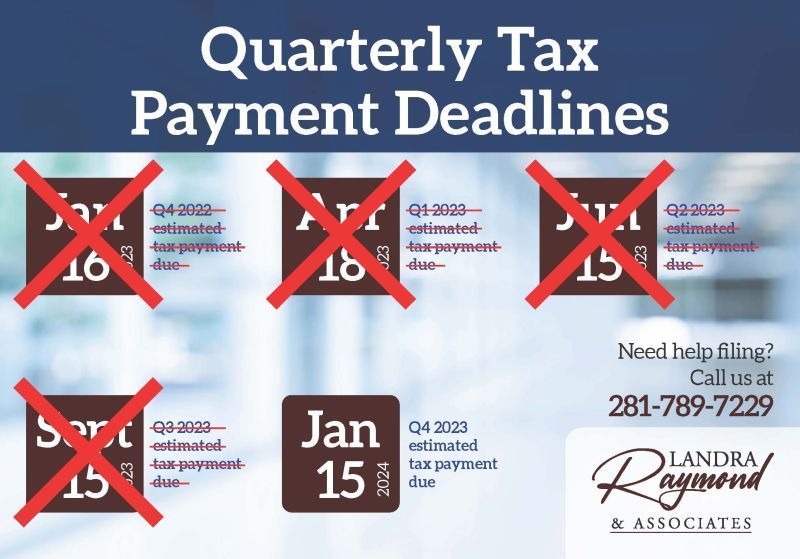

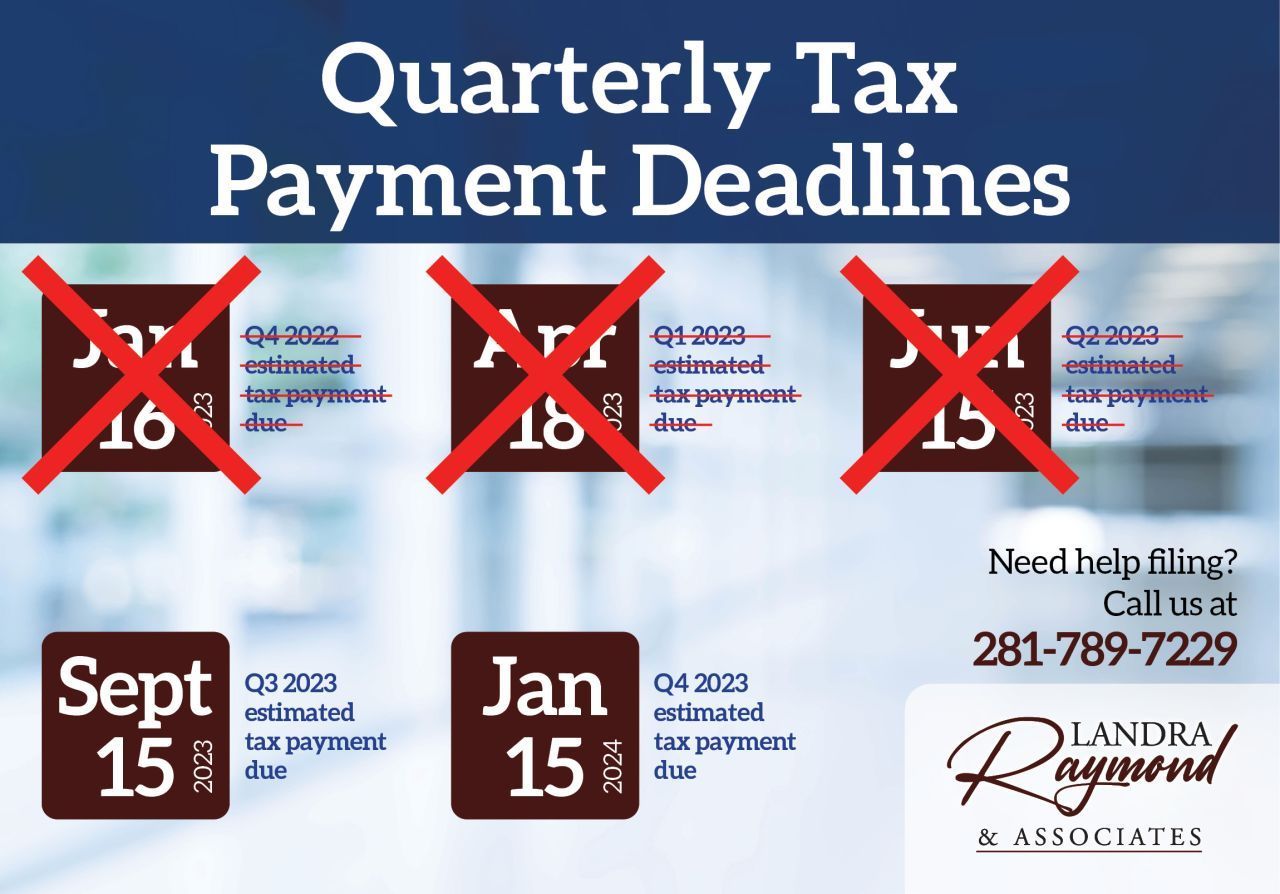

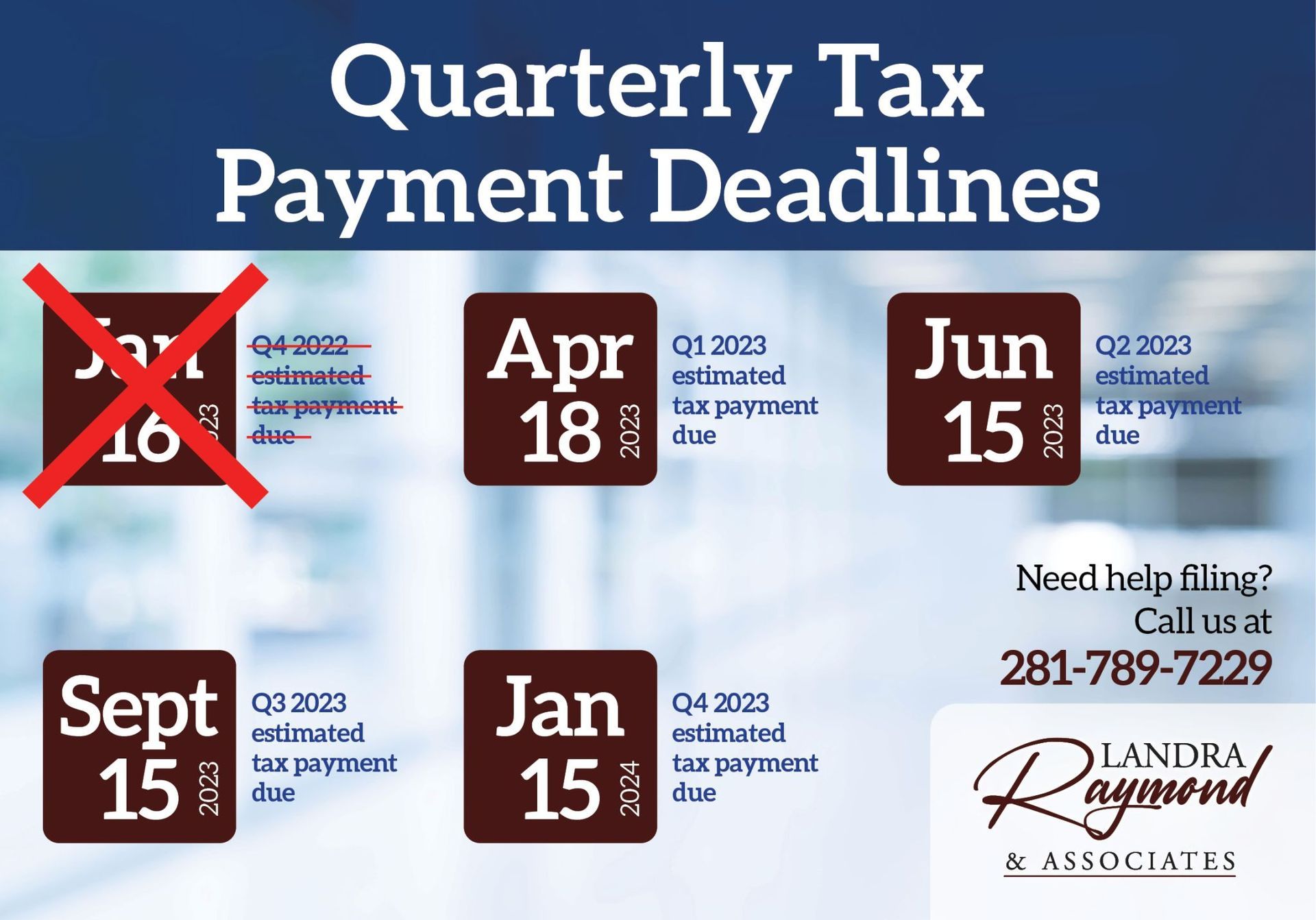

Are you ready for the next quarterly tax payment deadline as a business owner? - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

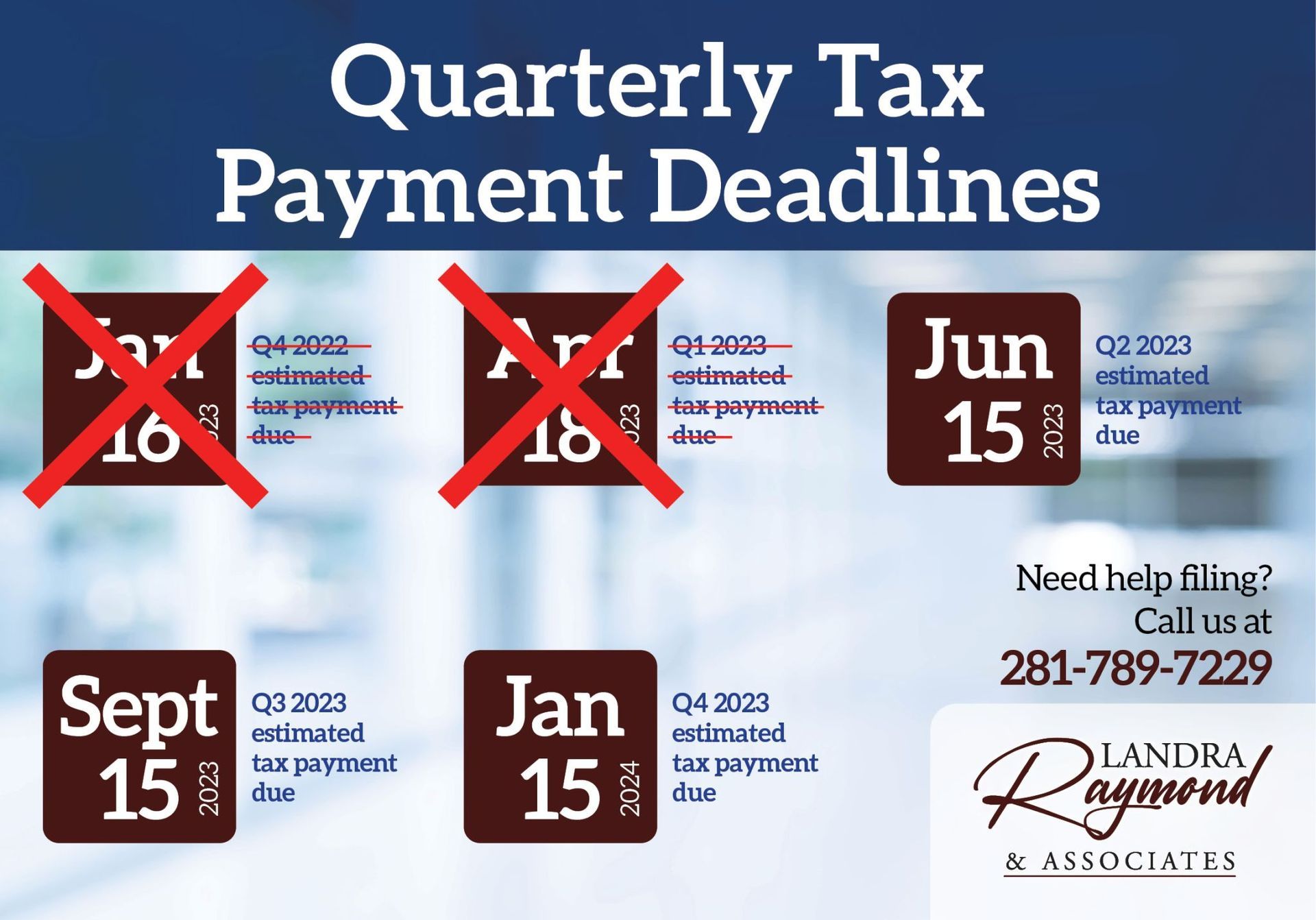

Are you ready for the next quarterly tax payment deadline as a business owner? - June 15: Q2 2023 estimated tax payment due - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Taxes for C-Corporations are due on April 18. Are you prepared to send everything to the IRS? With decades of experience dealing with accounting, tax, and legal project s, the Landra Raymond & Associates team can help ensure you're ready for deadlines. Future deadlines include: - Sept 15: Deadline for extended partnership and S-corporation returns - Oct 16: Deadline for extended C-corporation returns

As a business, are you ready for quarterly tax payment deadlines?

- April 18: Q1 2023 estimated tax payment due

- June 15: Q2 2023 estimated tax payment due

- September 15: Q3 2023 estimated tax payment due

- January 15: Q4 2023 estimated tax payment due

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.