Happy Thanksgiving!

On behalf of the Landra Raymond & Associates team, we hope you and your family have a very Happy Thanksgiving. Our offices will be closed Thursday and Friday, but we're available following Monday if you need anything.

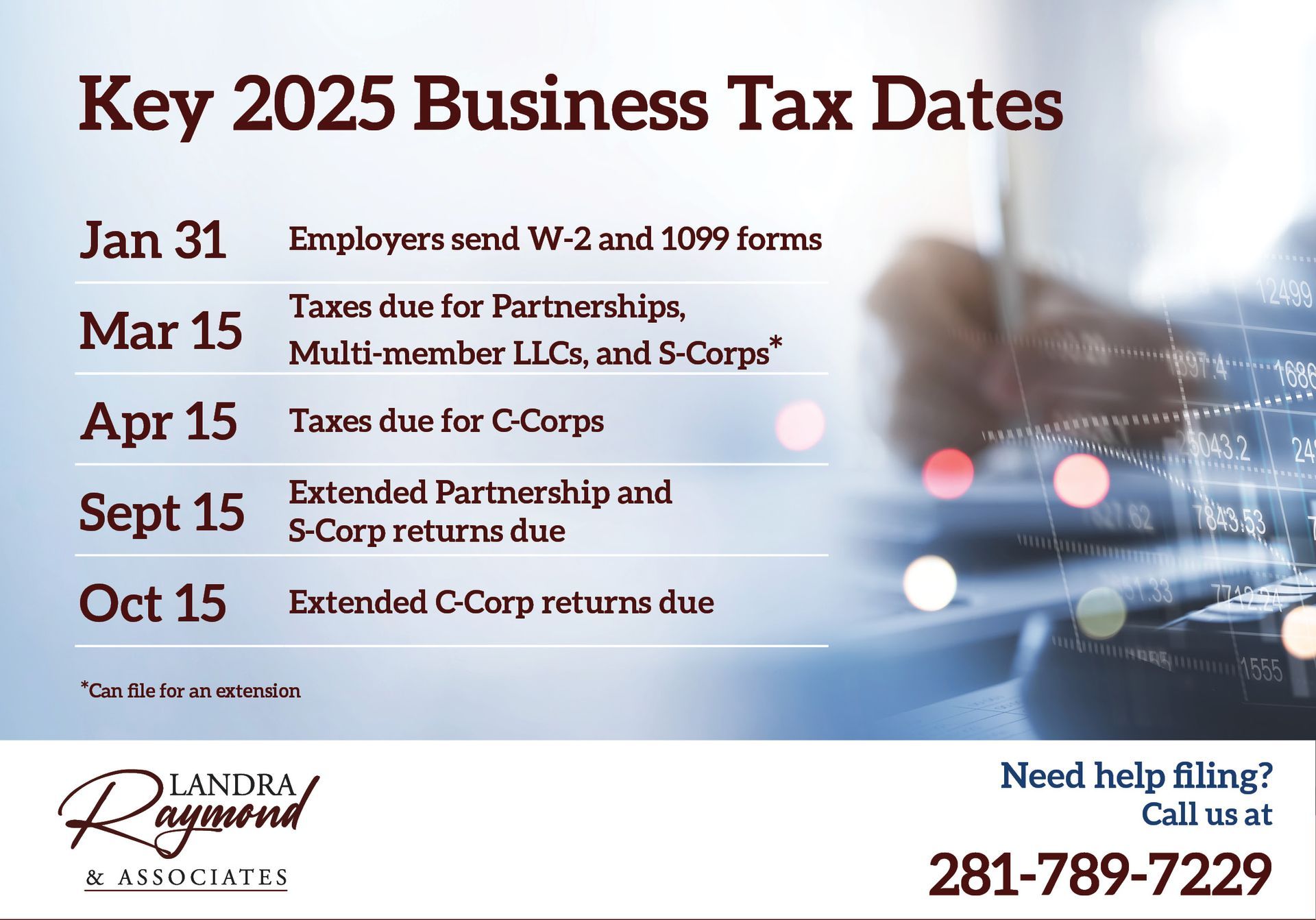

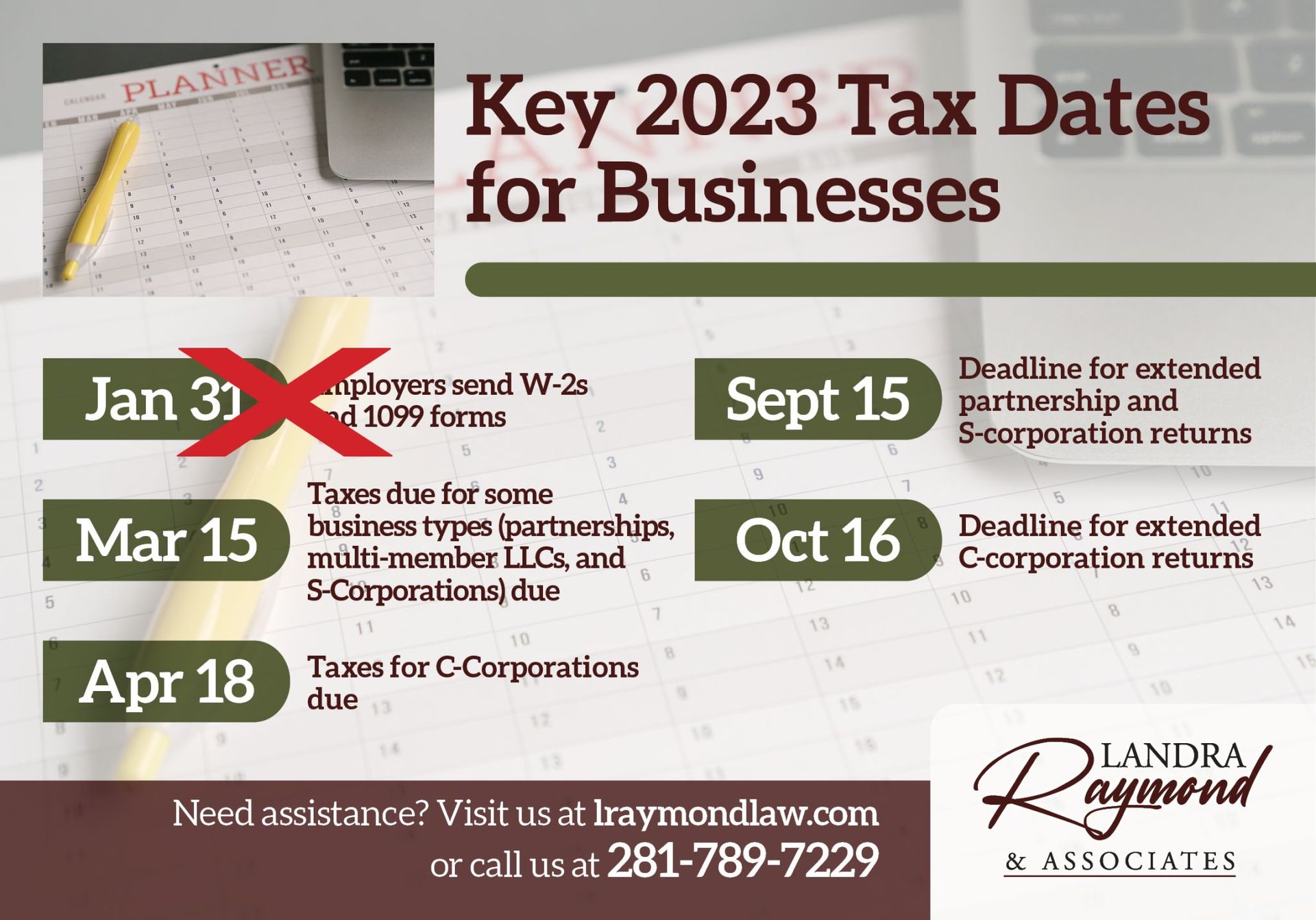

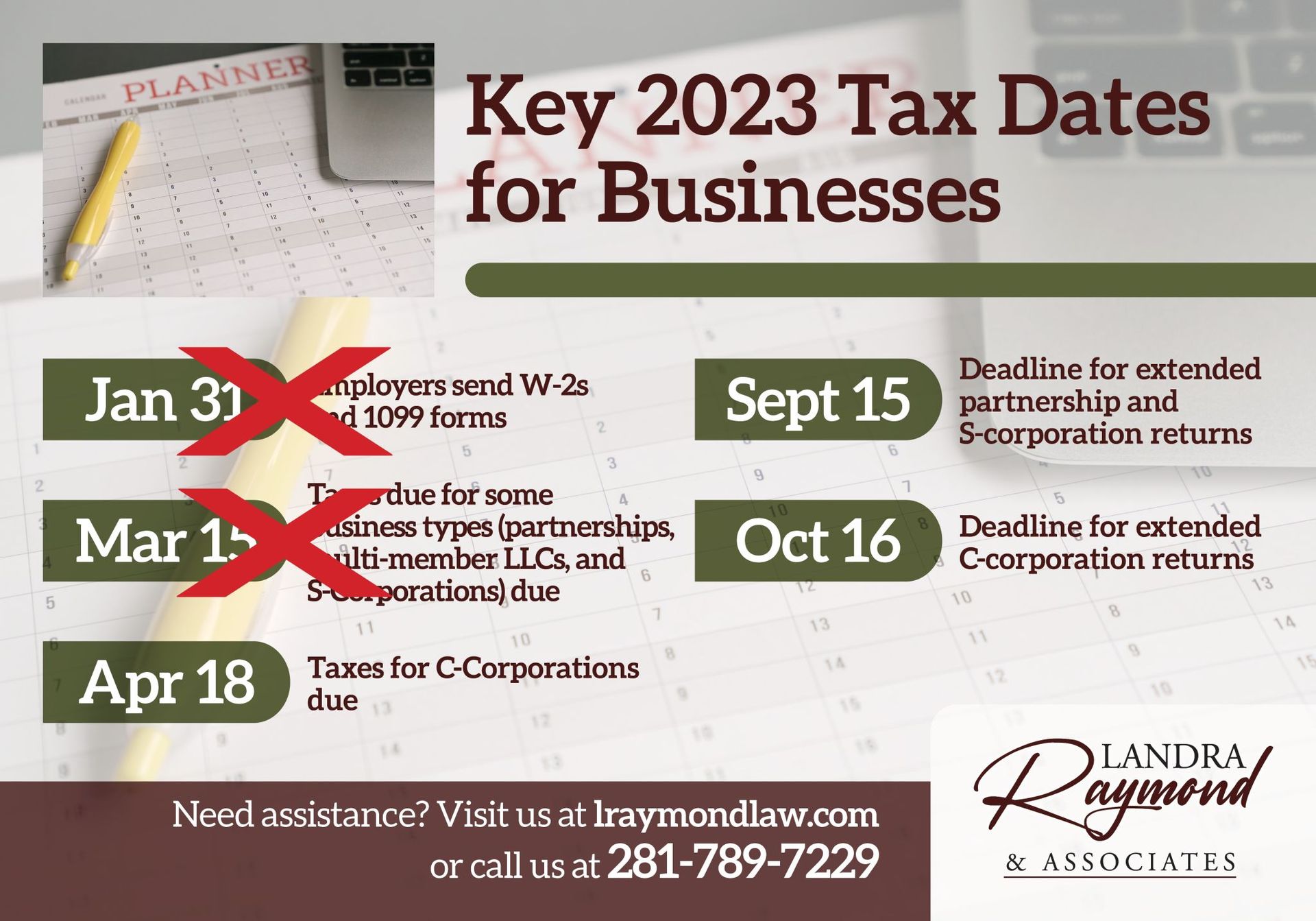

The last major business tax deadline is October 16, when your extended C-corporation returns are due. Are you ready to submit everything to the IRS? With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready to submit your extended partnership and S-corporation returns? The deadline is September 15, and will be here shortly. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines. The next deadline is Oct 16: extended C-corporation returns due.

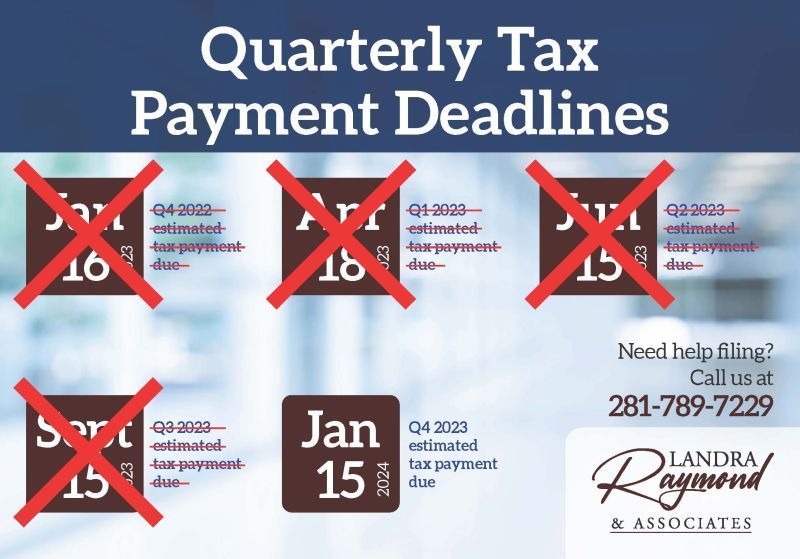

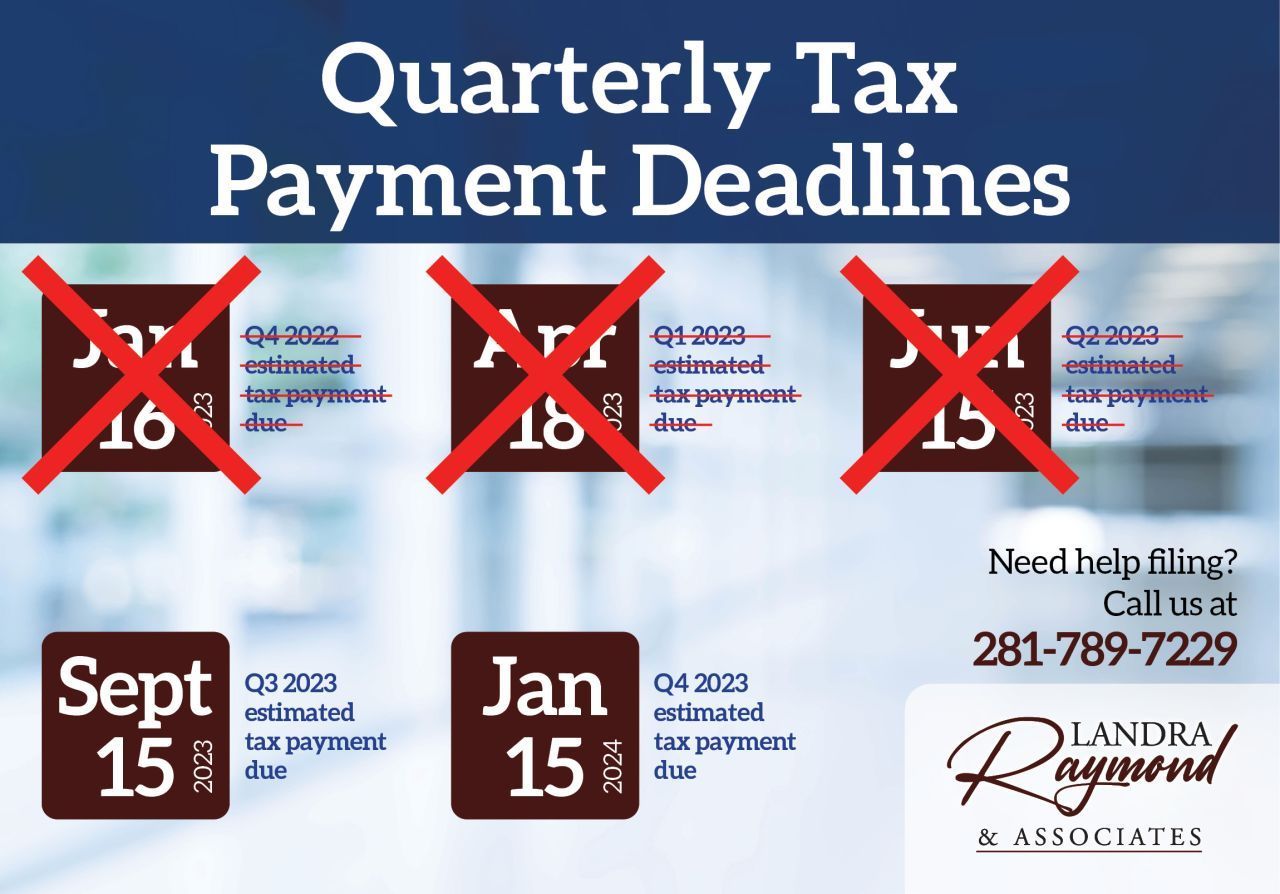

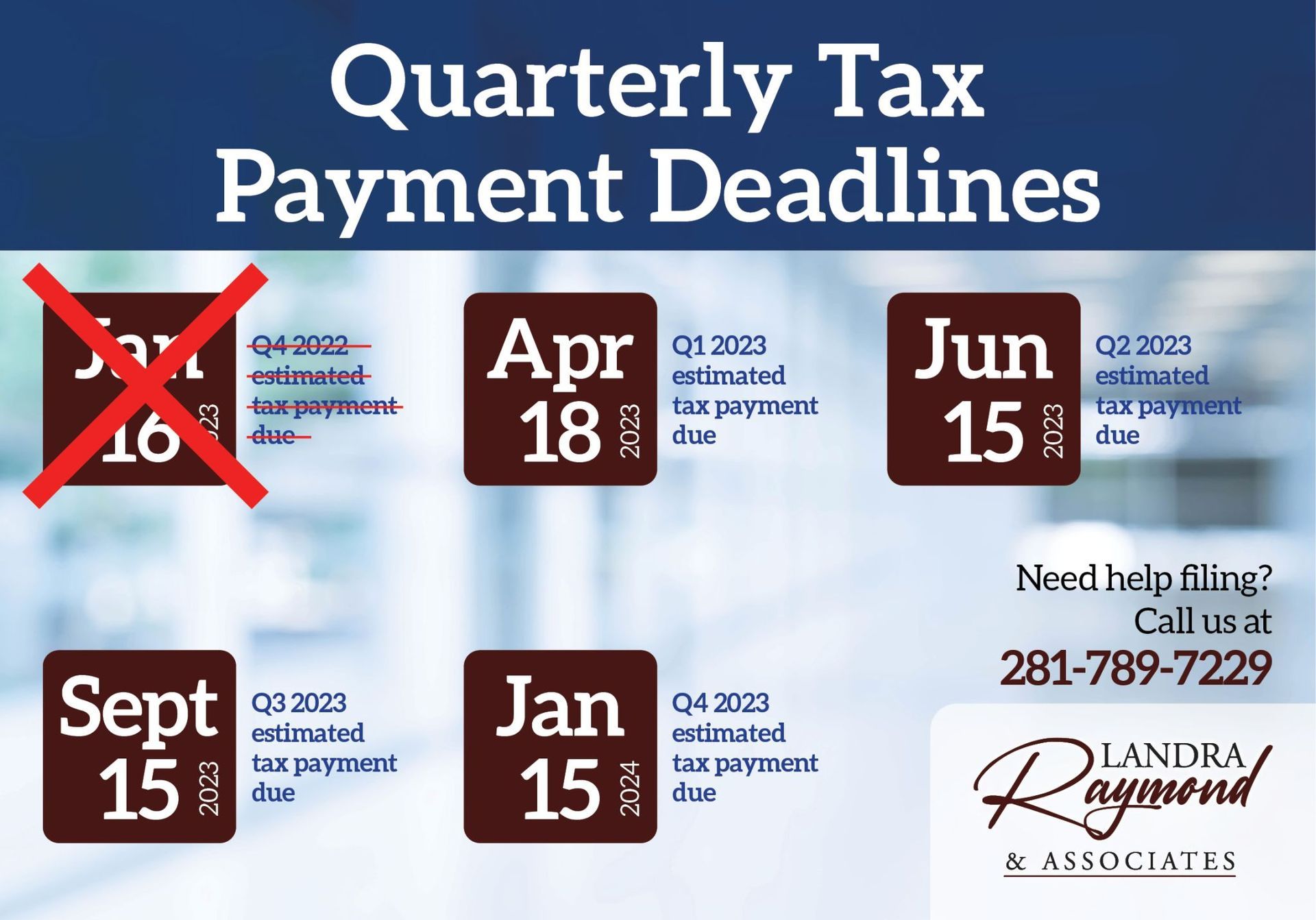

Are you ready for the next quarterly tax payment deadline as a business owner? - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready for the next quarterly tax payment deadline as a business owner? - June 15: Q2 2023 estimated tax payment due - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Taxes for C-Corporations are due on April 18. Are you prepared to send everything to the IRS? With decades of experience dealing with accounting, tax, and legal project s, the Landra Raymond & Associates team can help ensure you're ready for deadlines. Future deadlines include: - Sept 15: Deadline for extended partnership and S-corporation returns - Oct 16: Deadline for extended C-corporation returns

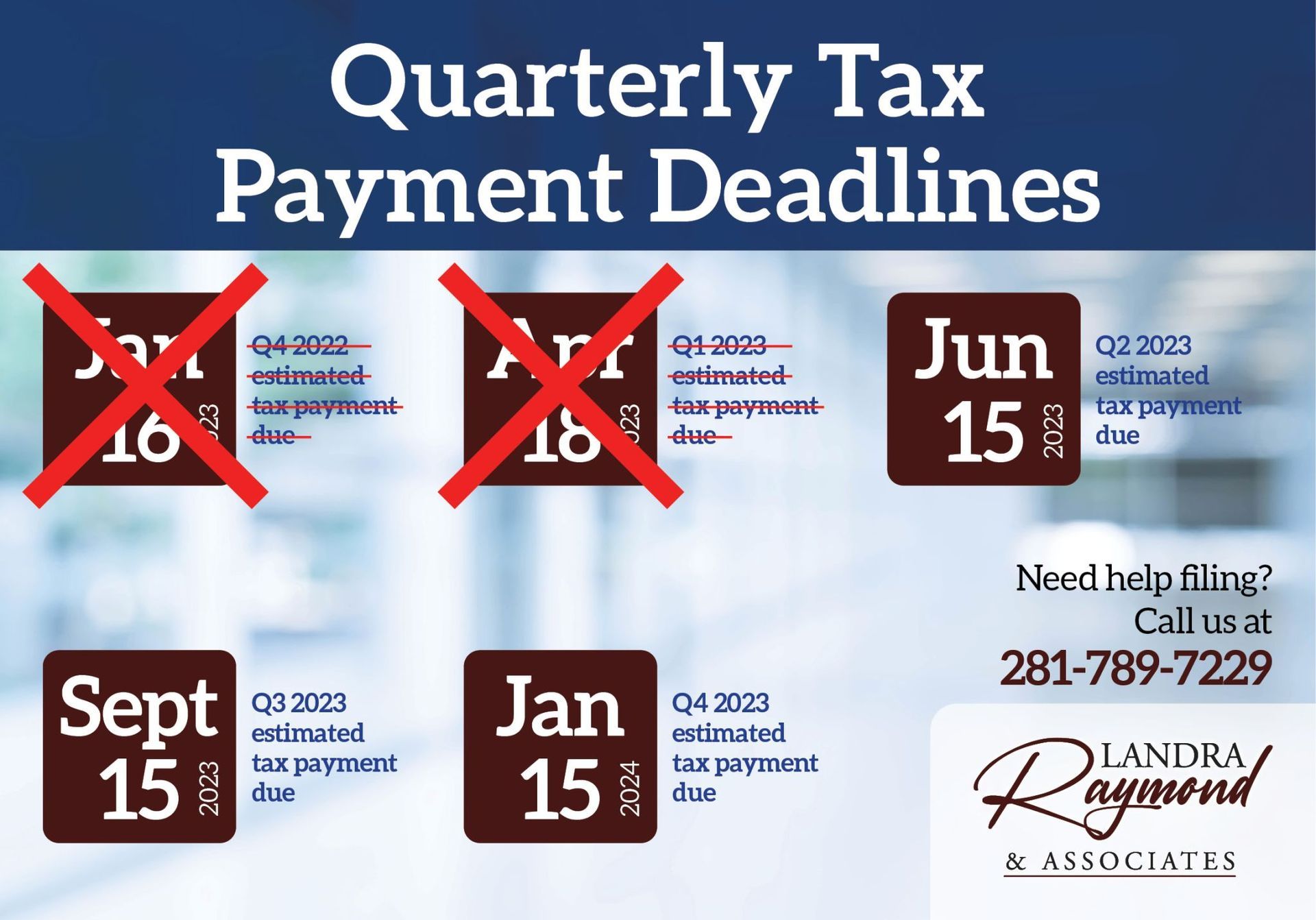

As a business, are you ready for quarterly tax payment deadlines?

- April 18: Q1 2023 estimated tax payment due

- June 15: Q2 2023 estimated tax payment due

- September 15: Q3 2023 estimated tax payment due

- January 15: Q4 2023 estimated tax payment due

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.