Merry Christmas and Happy New Year!

What an incredible year of blessings. Thank you to all of our customers.

On behalf of the Landra Raymond & Associates team, have a Very Merry Christmas and Happy New Year. Be safe and enjoy your time with your family and friends.

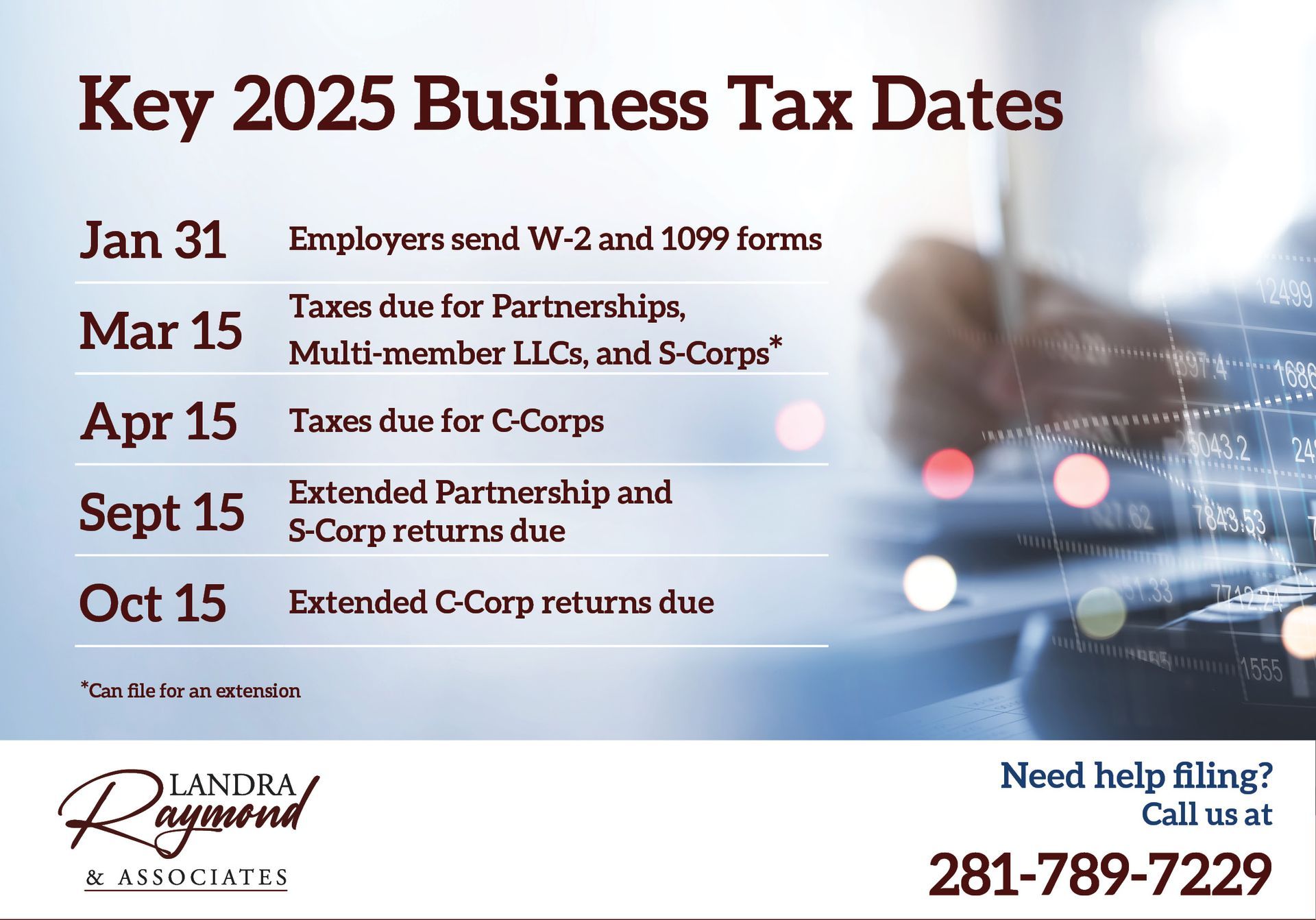

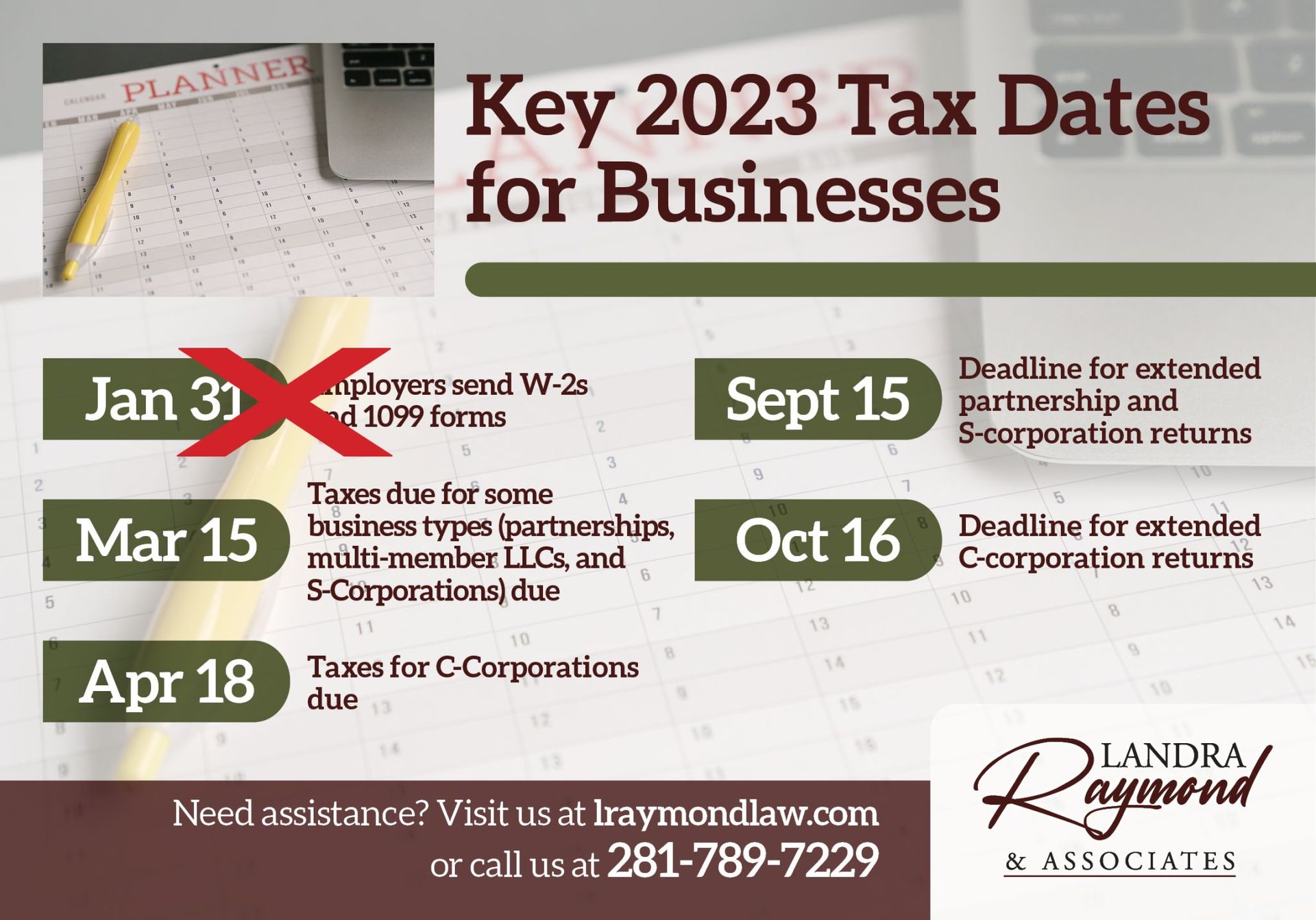

The last major business tax deadline is October 16, when your extended C-corporation returns are due. Are you ready to submit everything to the IRS? With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready to submit your extended partnership and S-corporation returns? The deadline is September 15, and will be here shortly. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines. The next deadline is Oct 16: extended C-corporation returns due.

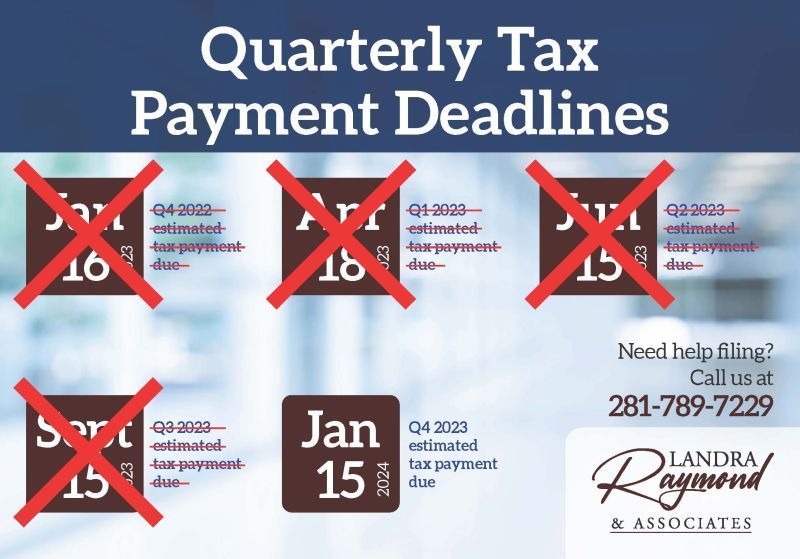

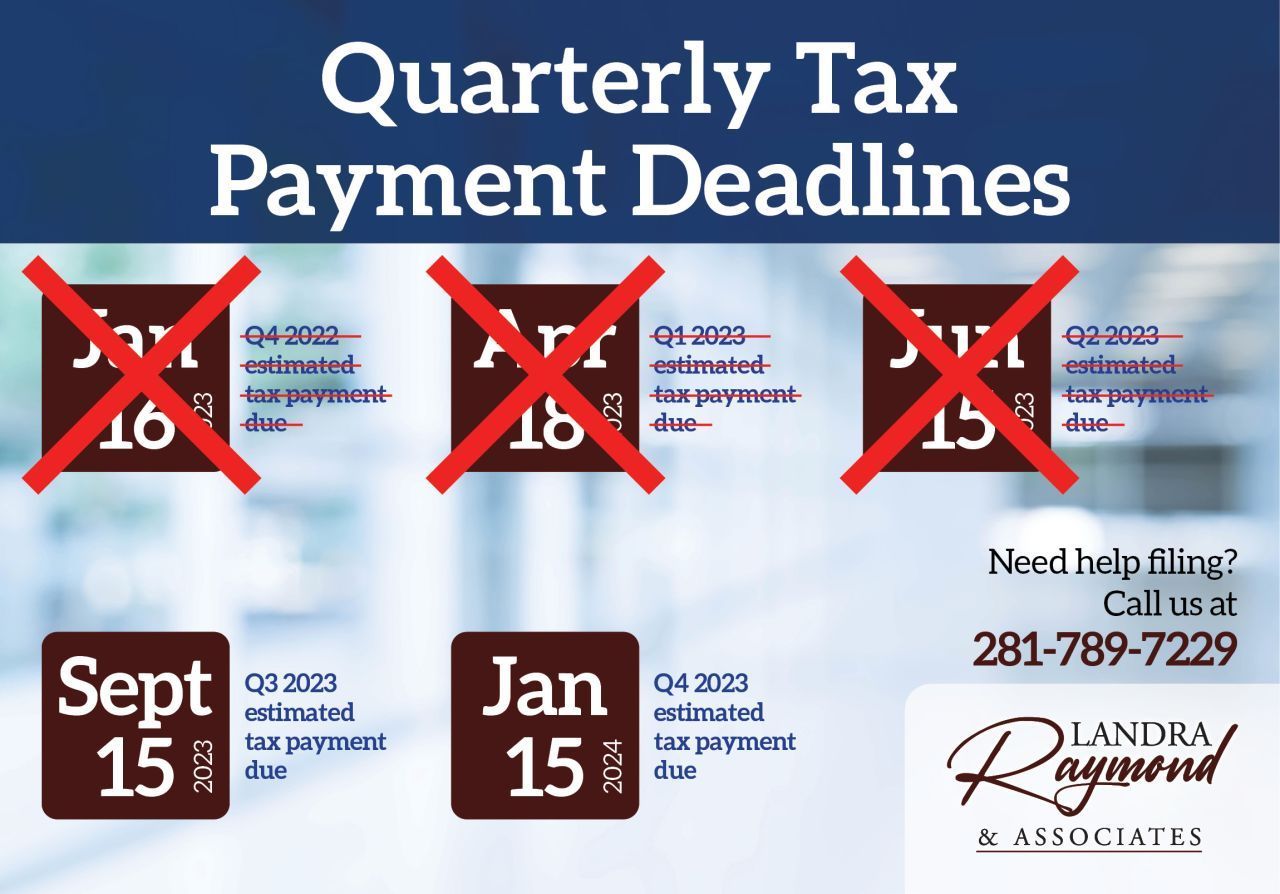

Are you ready for the next quarterly tax payment deadline as a business owner? - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

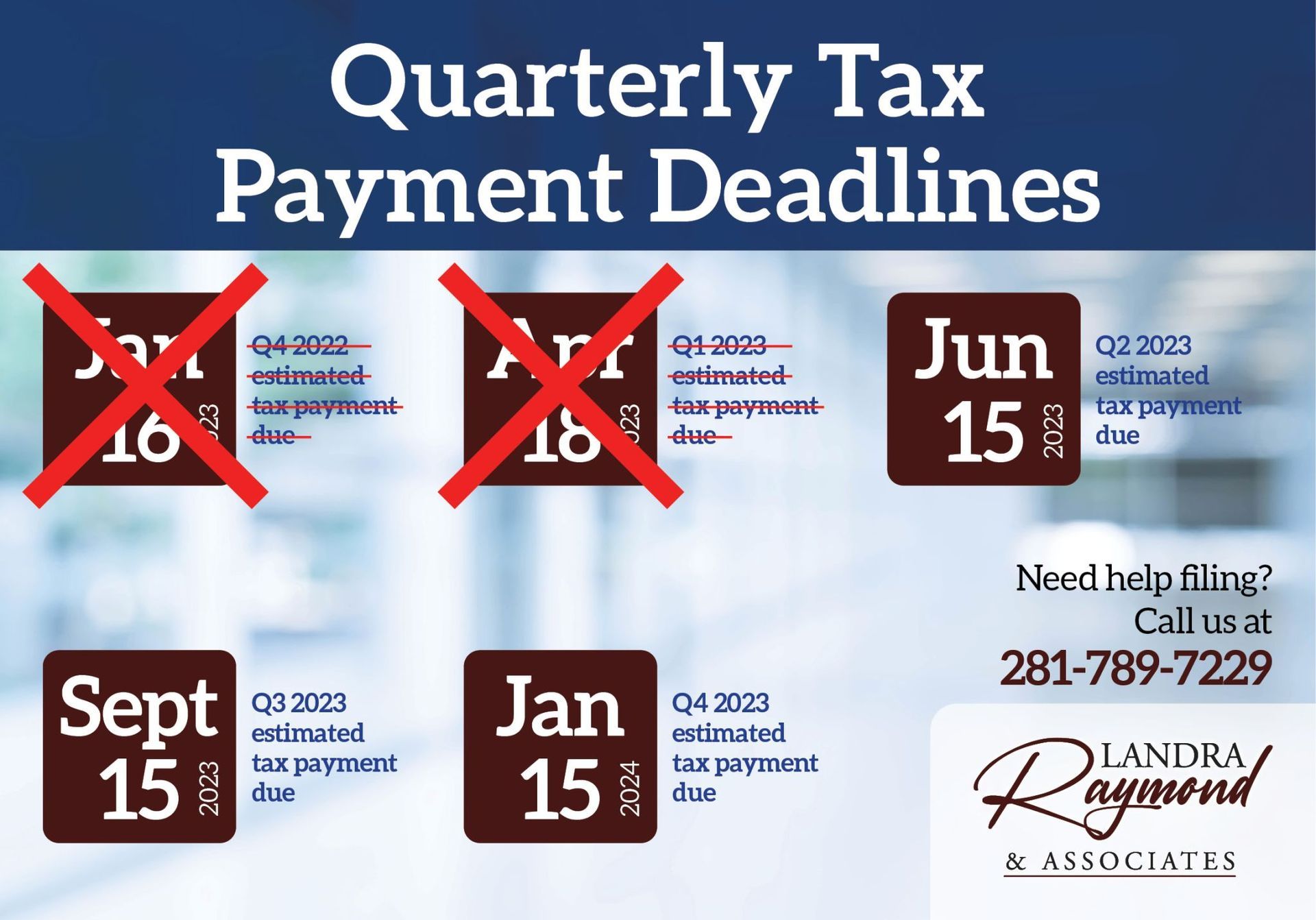

Are you ready for the next quarterly tax payment deadline as a business owner? - June 15: Q2 2023 estimated tax payment due - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

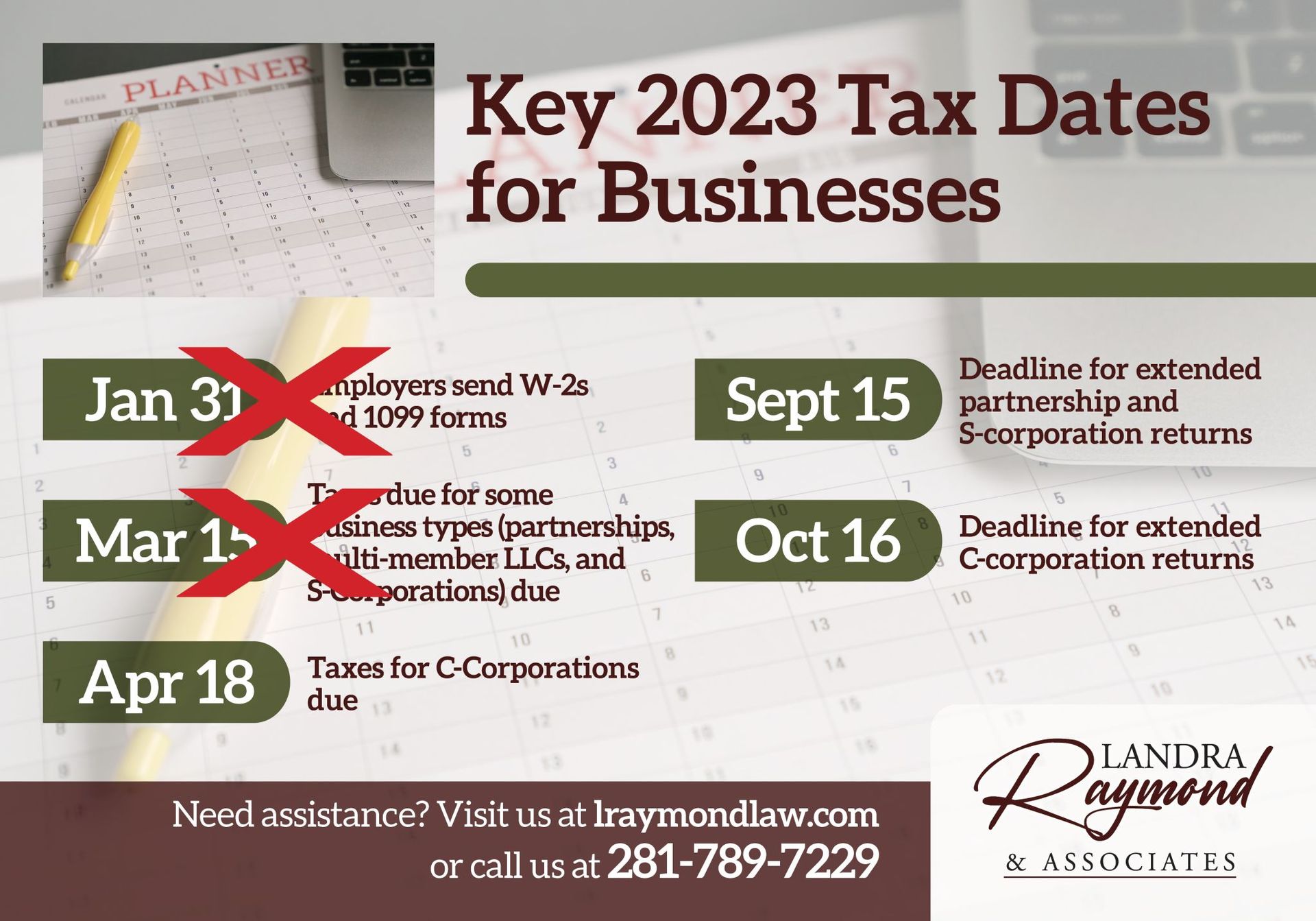

Taxes for C-Corporations are due on April 18. Are you prepared to send everything to the IRS? With decades of experience dealing with accounting, tax, and legal project s, the Landra Raymond & Associates team can help ensure you're ready for deadlines. Future deadlines include: - Sept 15: Deadline for extended partnership and S-corporation returns - Oct 16: Deadline for extended C-corporation returns

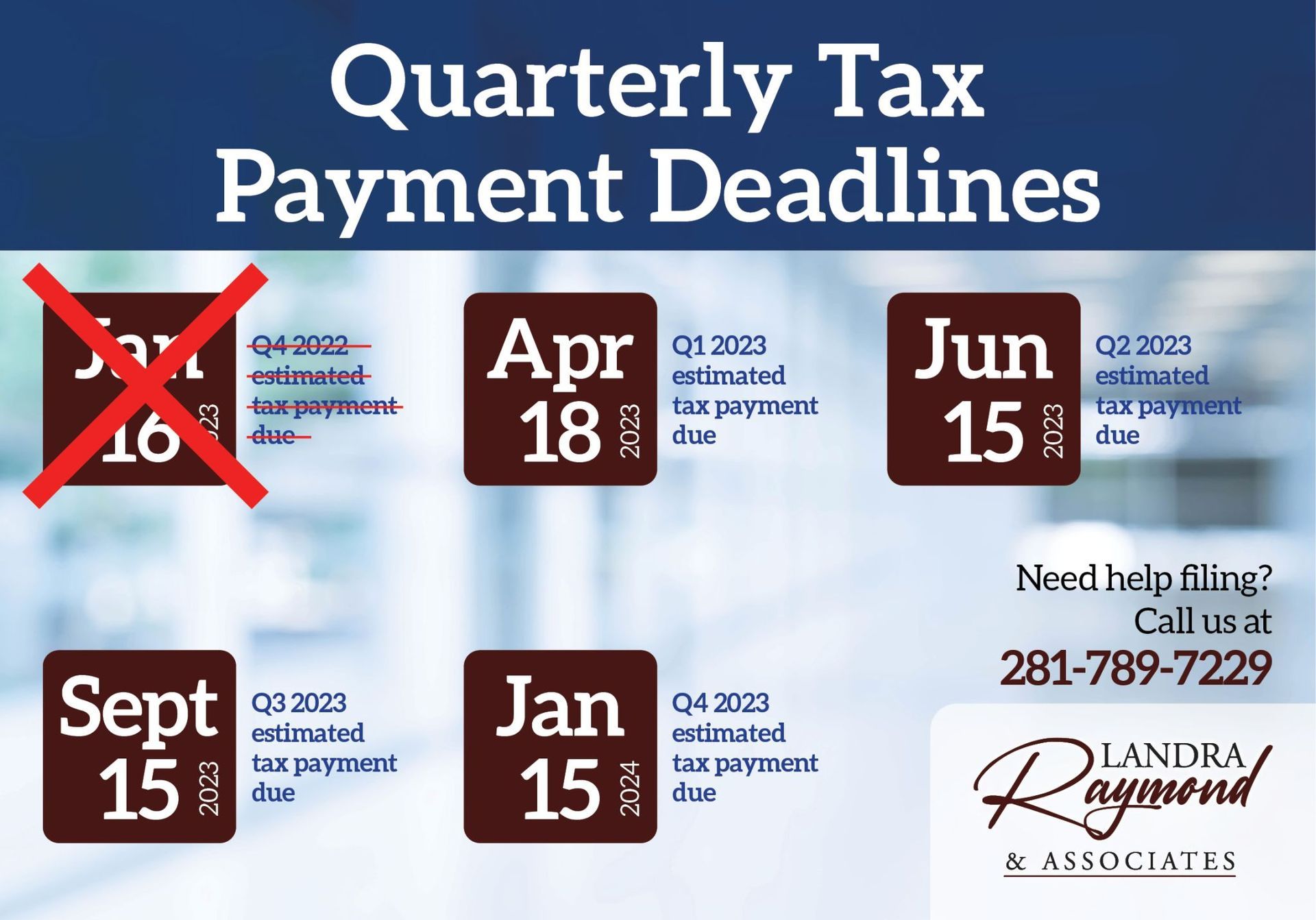

As a business, are you ready for quarterly tax payment deadlines?

- April 18: Q1 2023 estimated tax payment due

- June 15: Q2 2023 estimated tax payment due

- September 15: Q3 2023 estimated tax payment due

- January 15: Q4 2023 estimated tax payment due

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.