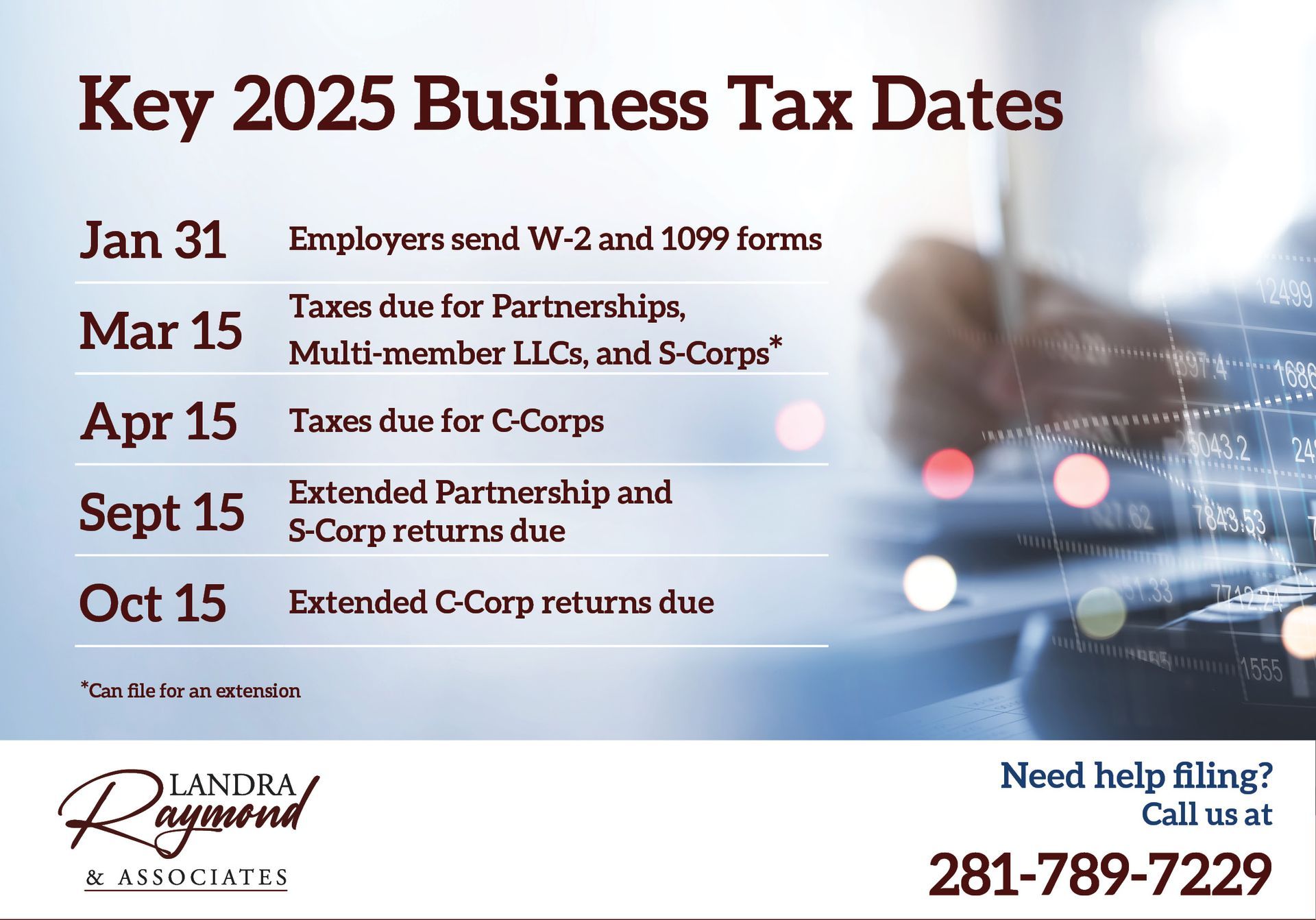

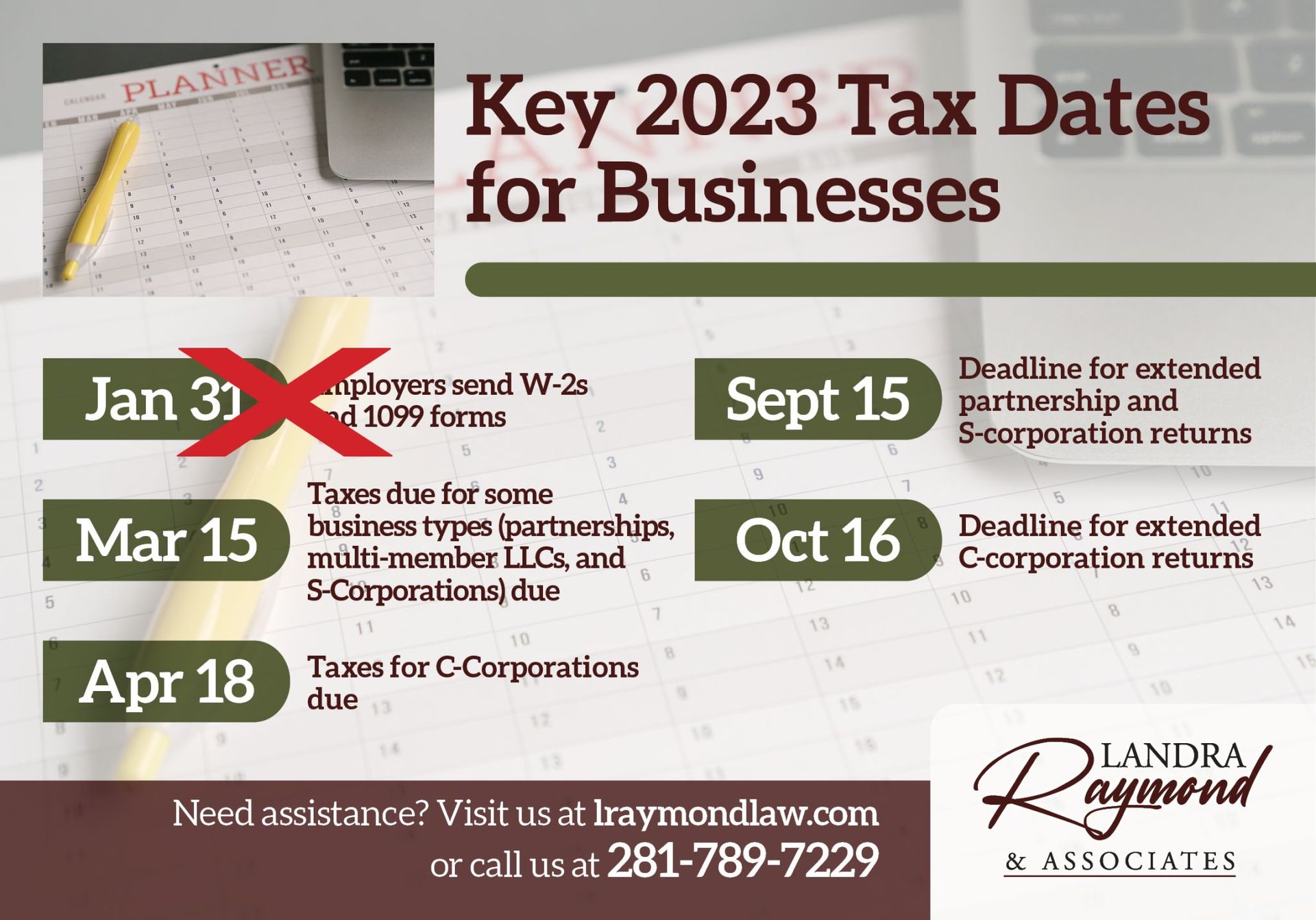

Key Deadlines This Month

Don't forget! There's several key deadlines this month if you're a business.

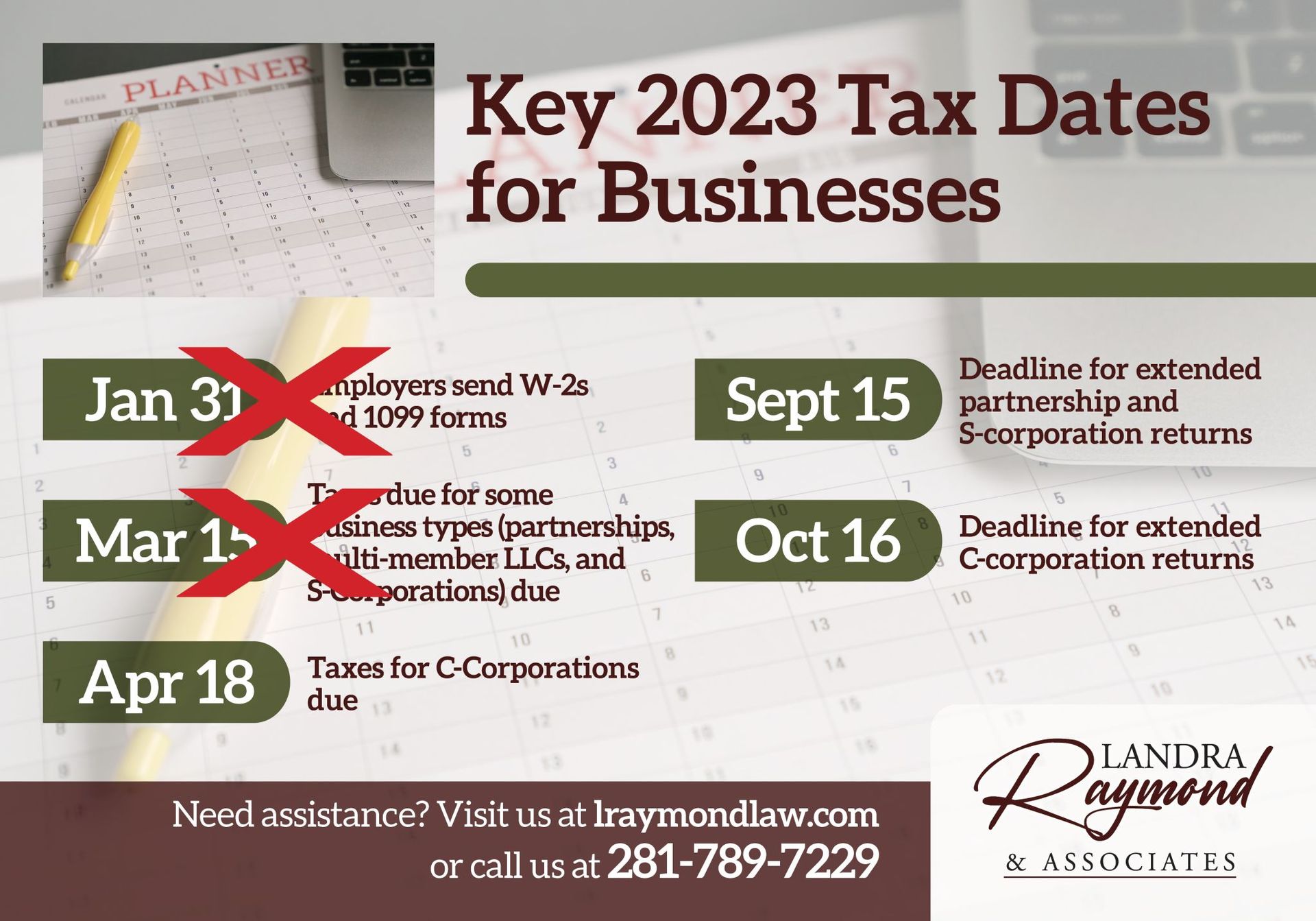

- March 15: Deadline to file your corporate tax returns (Forms 1120, 1120-A, and 1120-S) for tax year 2021, or to request an automatic six-month extension of time to file (Form 7004) for corporations that use the calendar year as their tax year, and for filing partnership tax returns (Form 1065) or to request an automatic six-month extension of time to file (Form 7004).

- March 31, 2022: Deadline for businesses to e-file Forms 1099 and 1098 to the IRS, except Form 1099-NEC.

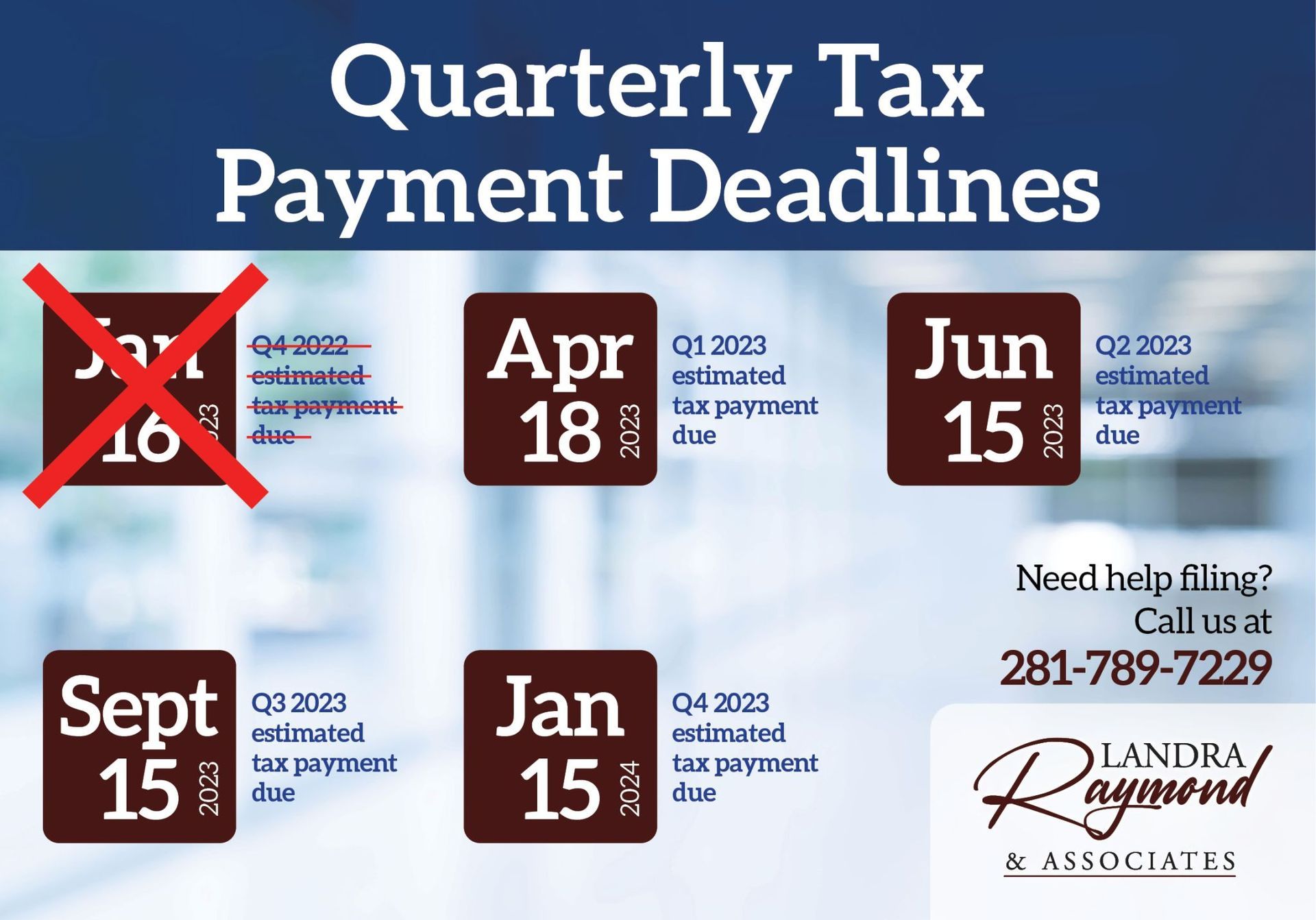

The Landra Raymond & Associates team is here to help answer your questions and file your business or personal returns. Contact us at 281-789-7229.