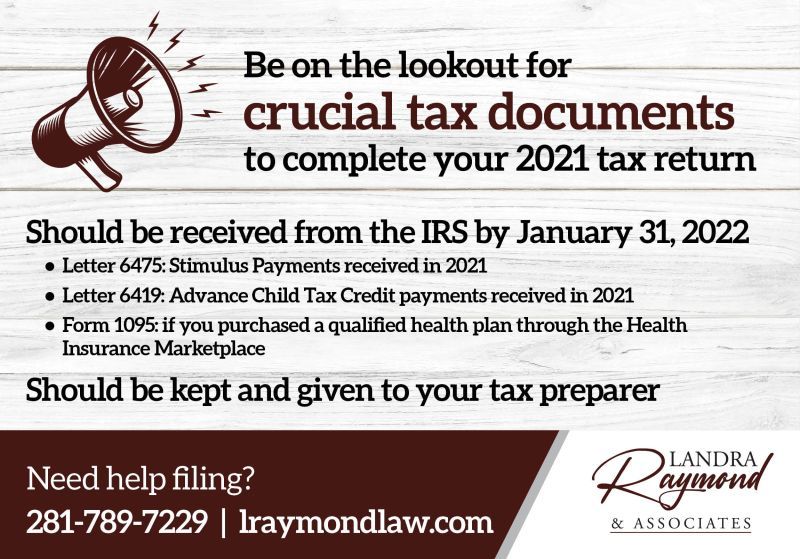

Be aware of these crucial documents...

It's that time of year of again! As you start to pull together all your documentation so you can file taxes, be on the lookout for some crucial tax documents that you'll need to give your tax preparer (or if you'll do them yourself).

In addition to your regular documents (W2, 1099, etc.), you should receive a few additional ones from the IRS by January 31, 2022. These are new documents so be sure you hold onto them and don't throw them away. If you don't receive, be sure to contact the IRS.

• Letter 6475: Stimulus Payments received in 2021

• Letter 6419: Advance Child Tax Credit payments received in 2021

• Form 1095: if you purchased a qualified health plan through the Health Insurance Marketplace

Need help filing? Contact the team at Landra Raymond & Associates at 281-789-7229.